When to start Social Security—Sooner, later or on time?

- My Social Benefit

- Jun 27, 2019

- 3 min read

Updated: Jul 22, 2019

Your decision on filing for Social Security benefits is one of the biggest financial decisions you’ll make.

Should you start benefits sooner or later or on time? The choice you make will affect how much money you’ll have for essential living expenses for the rest of your life.

And for the most part, your filing decision is permanent, too.

So what’s the best option—File early to start Social Security as soon as possible? Delay your benefits so your monthly income is larger? Or file on time, as soon as you’re eligible for full benefits?

The answer will be different for everyone. Here’s the best course of action: first, get up-to-speed on the rules so you understand the choices you make; second, meet with a financial advisor or planner who can help you make this decision in context of your overall financial plan.

Know the rules before you file

Let’s start with some basic Social Security filing rules, beginning with two important acronyms:

PIA or primary insurance amount is the amount of the full monthly Social Security benefit you are eligible to receive at your full retirement age or FRA.

How PIA is calculated is complicated. If you want to know how much to expect from Social Security at your full retirement age, you can use an online calculator to compute an estimate or go to your Social Security account on the official Social Security web site (www.socialsecurity.gov).

Your FRA depends on the year you were born. If your birth year is 1952 or earlier, you’ve already reached FRA and can start to receive full Social Security benefits immediately. If you were born in 1953 or 1954, you’re FRA is 66. For birth years between 1955 and 1959, full retirement age is somewhere between age 66 and 67. Anyone born after 1960 has an FRA of 67.

Getting Social Security before FRA

You can file early for Social Security, before you reach your full retirement age, but doing so will lower your PIA. That means you’ll receive less than the full Social Security benefit you’re eligible for.

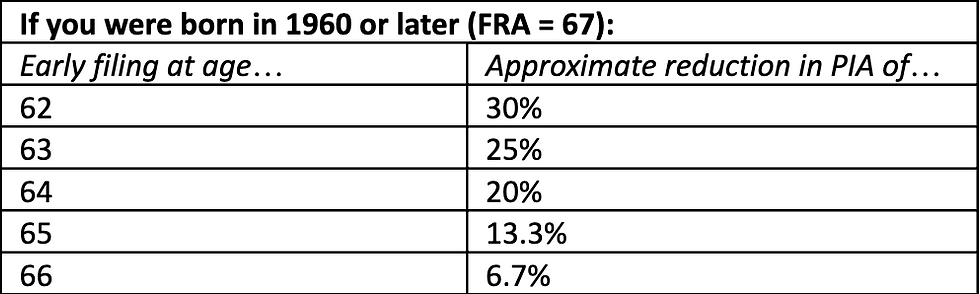

You can start receiving Social Security benefits as early as age 62. The earlier you file for benefits, the more your monthly payment or PIA will be reduced. (How much less is outlined in the table below, for someone with a full retirement age of 67.)

More importantly, the reduction in your benefits is permanent. So consider the choice to file early carefully.

That doesn’t mean you shouldn’t file early—for many people, starting Social Security as soon as possible is their best financial option, especially if they need income to cover basic living expenses.

Delaying your Social Security benefits

On the other hand, you can wait to file for Social Security beyond your FRA, up to age 70. If you delay your benefits, you can increase the amount of your monthly Social Security payment.

For every year beyond your FRA that you wait to take Social Security, your PIA increases by 8%. That means, if you were born after 1960 and your FRA is 67, waiting three years to start Social Security would mean a 24% increase in your primary insurance amount.

Is delaying Social Security the best decision? Not necessarily. Again, it depends on your individual situation. If you’re still working and have earned income to cover your living expenses, perhaps you could put off your filing decision and increase the size of your benefit.

Likewise, if you have retirement savings you can tap for essential income, you may be able to wait to take Social Security a few years. Then again, money you have invested in an IRA, for example, could earn more than the 8% annual increase you’d get from delaying Social Security.

Plus, the full amount of your IRA withdrawals would be taxable at as ordinary income. At least a portion of your Social Security benefit is exempt from federal income tax. For these and more reasons, it may make more sense to file for Social Security on time and allow money you have invested in retirement accounts to grow for your later years.

Don’t make a decision on your own

Your life expectancy and marital status are other important factors that come into play in your Social Security filing decision. Both may influence your choice to file early or to delay benefits.

Because of all the different factors you need to consider before making your decision, you should consult with a financial advisor or planner.

Find a Social Security advisor in your area who understands the Social Security filing rules and can help you make a choice that’s suitable for your financial situation.

Comments